A finance company sought to achieve clear visibility into their lead and deal attribution data. Over a 4-month process, HarvestROI collaborated with the company to restructure their CRM, optimize pipelines, and lay the foundation for confident decision-making.

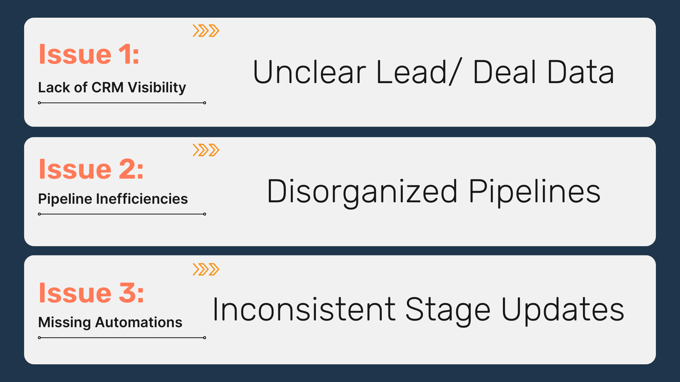

The Challenges

Before our intervention, the finance company faced significant hurdles in optimizing their CRM and aligning their internal processes:

- System Disorganization: The company struggled to identify gaps in their sourcing data and understand which attribution metrics could be accurately captured in their CRM. This created blind spots in lead and deal reporting.

- Pipeline Inefficiencies: Outdated and redundant pipelines caused confusion for the sales team, leading to inconsistent deal management and difficulty forecasting sales outcomes.

- Missing Automations: Critical automation, such as lifecycle stage updates, were absent or applied inconsistently, creating a lack of trust in the CRM’s data accuracy and overall reliability.

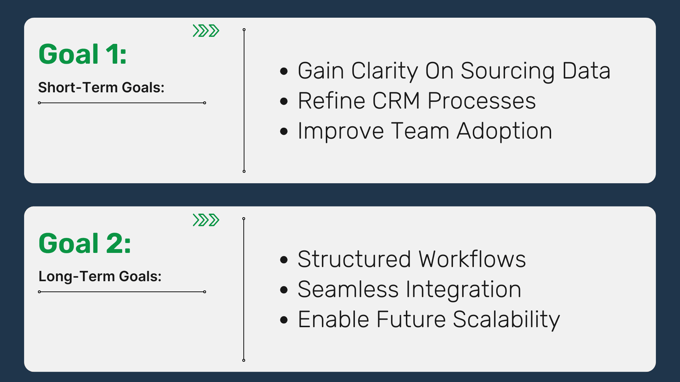

What They Wanted to Achieve

The client had two main objectives with our intervention:

Short-term Goals:

- Comprehensive Change Management: Conducted a thorough review of current attribution metrics, identifying which data points could be leveraged and where improvements were needed.

- Refine CRM Processes: Streamlined CRM processes by consolidating duplicate properties, removing redundant records, and organizing data for better reporting accuracy.

- Improve Team Adoption: Delivered hands-on training to key stakeholders, fostering confidence and encouraging widespread use of the updated system.

Long-term Goals:

- Structured Workflows: Designed workflows that ensured lifecycle stages and other critical properties were consistently updated across all records, reducing manual errors.

- Seamless Integration: Reviewed existing integrations and prepared the CRM environment for future development projects, ensuring smooth data flow between systems.

- Enable Future Scalability: Established a foundation for scalability by creating robust pipelines and preparing the team for ongoing CRM enhancements and data growth.

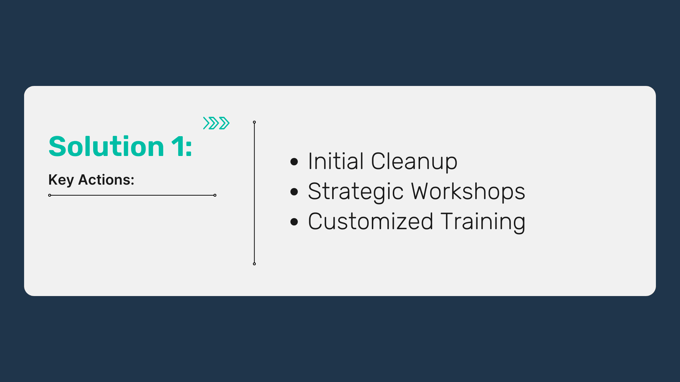

Our Solutions

To address the client's challenges, HarvestROI began by establishing a structured process for reviewing and refining their CRM environment. This included cleaning up outdated data, implementing targeted workshops, and delivering customized training. These efforts laid the groundwork for a fully optimized CRM system designed to support their immediate and long-term objectives.

Key Actions Included:

- Initial Cleanup: Conducted a comprehensive review of all existing CRM records to identify duplicates and outdated data. Designed and implemented a deduplication plan to clean the database and improve reporting accuracy. Updated outdated workflows to ensure seamless automation for daily operations.

- Strategic Workshops: Held interactive sessions with stakeholders to align data mapping and sales pipeline structures with operational goals. These workshops identified and resolved gaps in the pre-sales and lead-to-deal processes. Redesigned seven sales pipelines to ensure clarity, scalability, and proper alignment with team workflows.

- Customized Training: Delivered tailored training sessions to stakeholders, focusing on the CRM’s reporting capabilities and new features. This training emphasized hands-on practice, ensuring users felt confident in leveraging the optimized CRM. The training also prepared the team for seamless adoption of future integrations and scalable workflows.

The process concluded with a Reporting Workshop and final training sessions in mid-November 2024. This phased approach ensured that the finance company was equipped to leverage their newly structured CRM and confidence in their ability to integrate future data enhancements seamlessly.

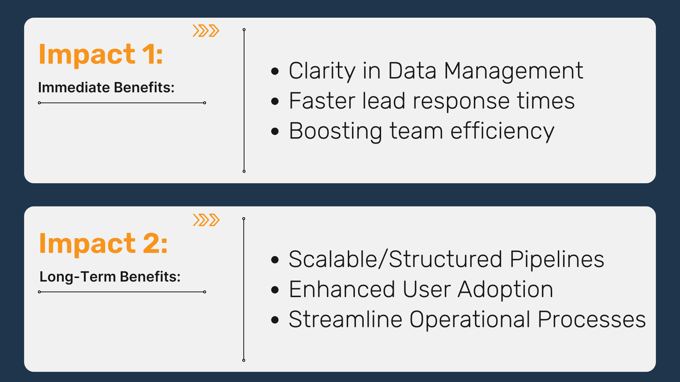

The Impact

Immediate Benefits:

- Clarity in Data Management: Cleaned and streamlined CRM data structure, making it easier for teams to interpret and leverage critical customer information.

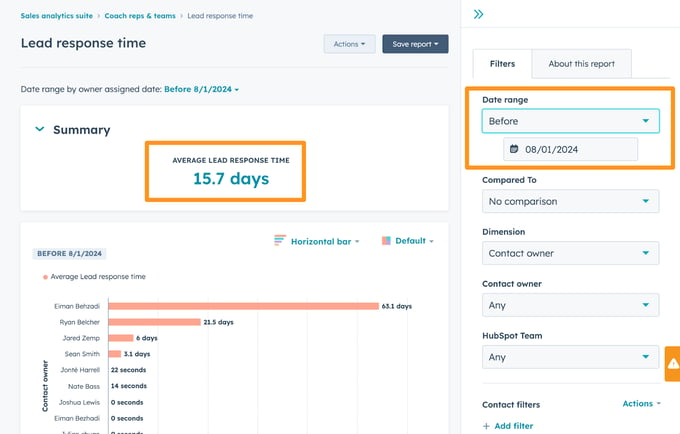

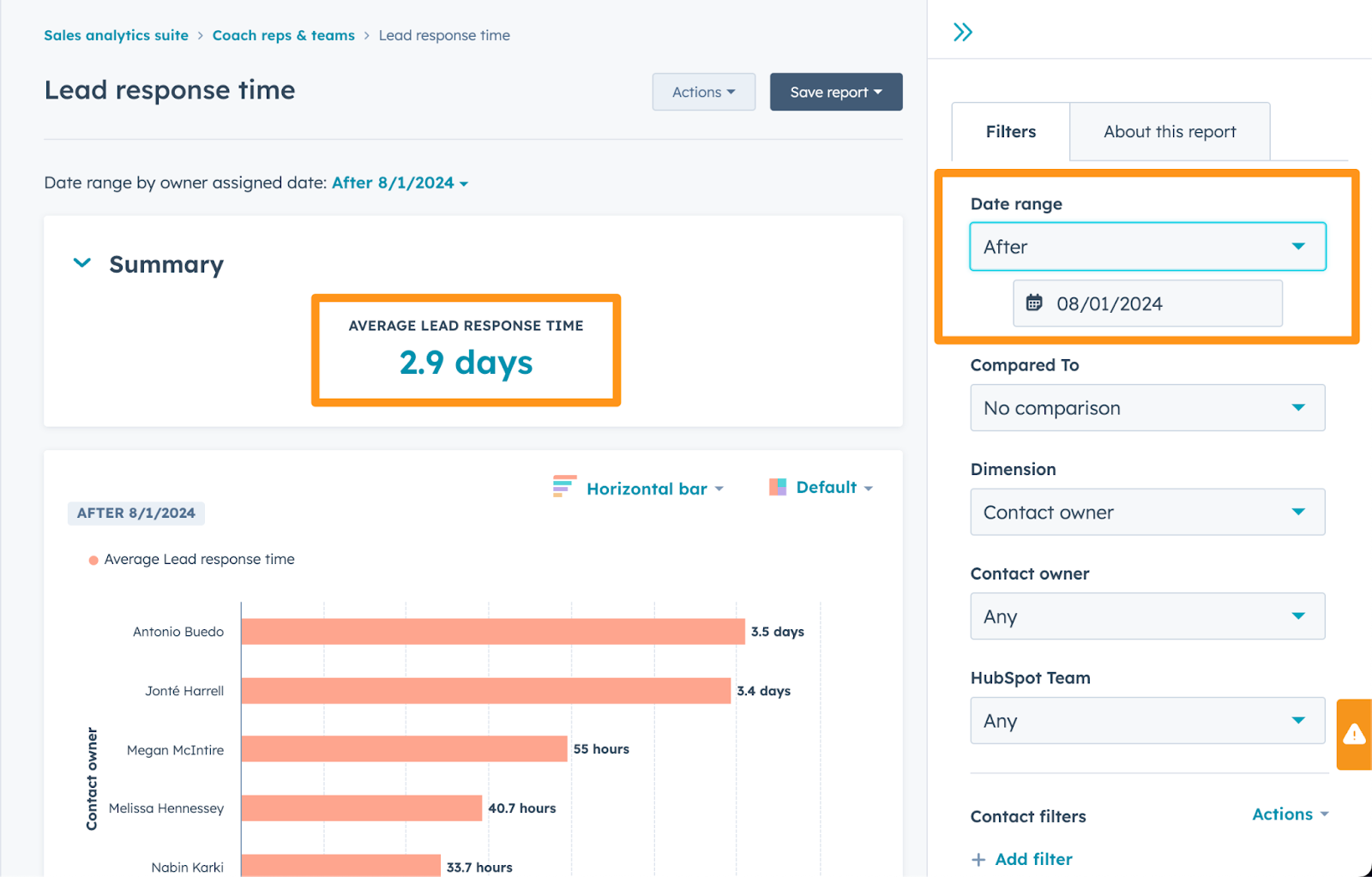

- Faster Lead Response Times: Automated workflows reduced lead response times from 15+ days to just 2.9 days, significantly improving customer engagement.

- Boosting Team Efficiency: Simplified processes and enhanced visibility empowered the team to perform tasks more effectively.

Long-term Benefits:

After Implementation:

Lead response time improved to 2.9 days.

After Implementation:

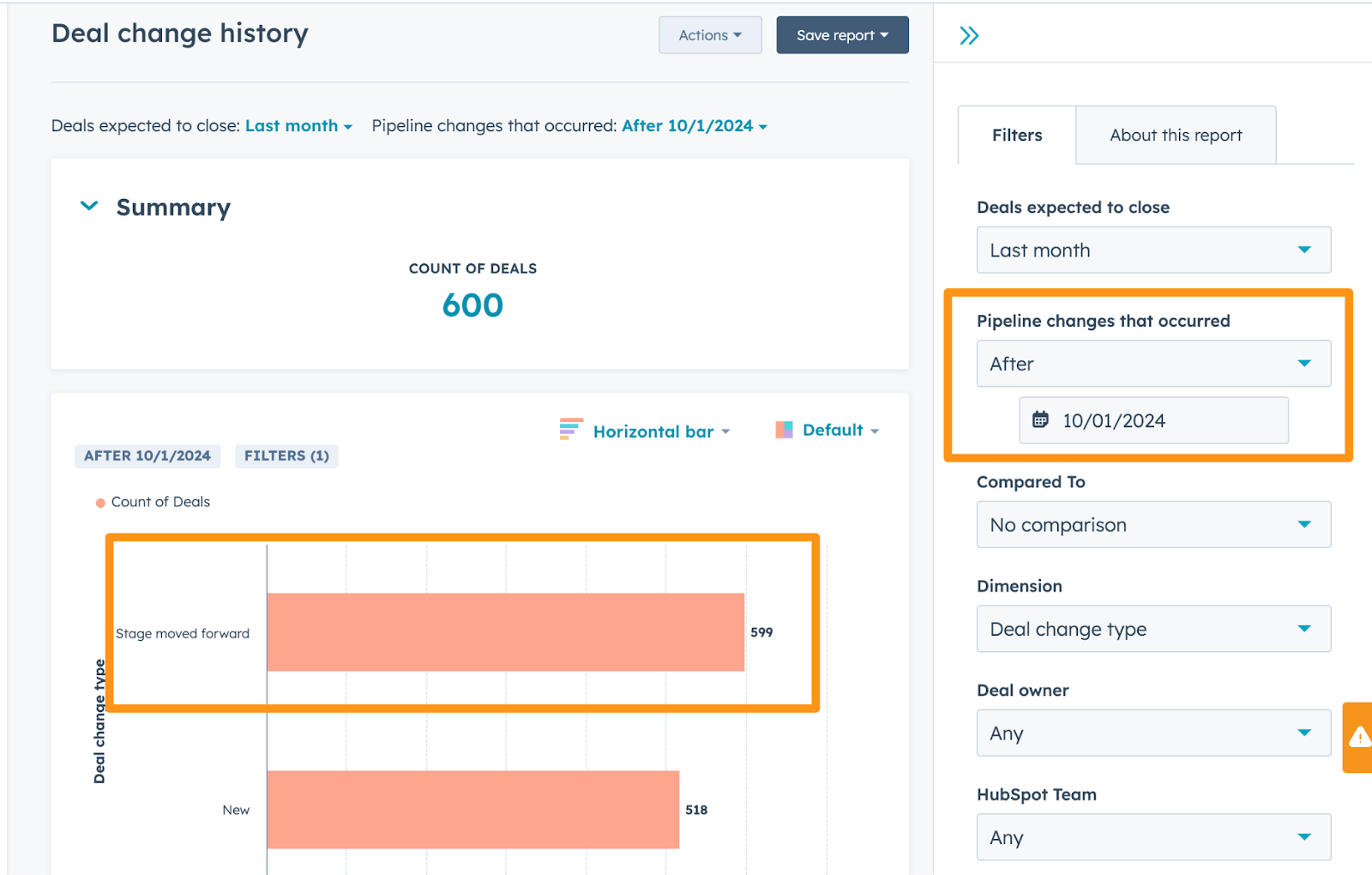

600 deals progressed through streamlined stages post-restructure.

What’s Next?

HarvestROI will continue to support the company through quarterly check-ins, ensuring their CRM evolves alongside their business needs and future integrations.

Final Thoughts

The finance company’s commitment to clarity and scalability made this collaboration a success. By addressing key challenges and implementing tailored solutions, they are now equipped for long-term growth and operational efficiency in the finance industry.

Read our customer review page!